43e Midi de la Microfinance et de l'inclusion financière

43nd Midi de la Microfinance et de l'inclusion financière

Watch the video of this Midi

Sharing financial expertise in risk management: exchange between a coach and a coachee

Coaching, accelerator of change

Bank of Luxembourg, April 18, 2018 | Coaching is a catalyst for change for a microfinance institution. Whether faced with financial, operational or even human risks, this approach is very often beneficial. This is in what allowed to highlight this 43rd Midi of microfinance dedicated to coaching in risk management, through the story and experience of Philippe Gerard, a recognized consultant in banking in Europe, and Yombo Odanou, at the head of a Togolese microfinance institution with nearly 40,000 clients.

"Risk management is not limited to credit"

Luc Vandeweerd, advisor to ADA management, also moderator of the debate, begins by setting the context by recalling that "Luxembourg is one of the world's leading financial markets, with known and recognized expertise in asset management". A knowledge that is exported to southern countries to help the poor. It is also an opportunity to point out that more than 50% of microfinance investment funds are now domiciled in the Grand Duchy. Then he asks Yombo Odanou to explain why he has used the risk management coaching program developed by ATTF Services - House of Training, in collaboration with ADA and ALRiM.

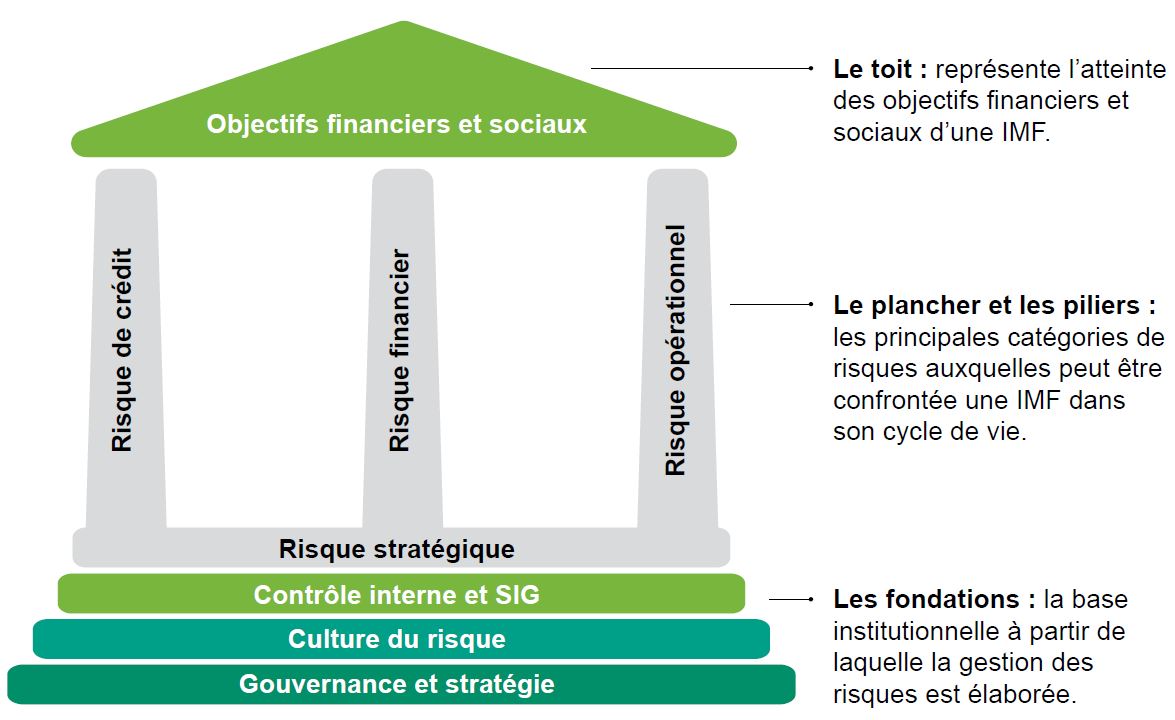

According to the Director General of the Coopérative d’Epargne et de Crédit des Artisans (CECA) in Togo, his microfinance institution faced in 2015 a deterioration in the loan portfolio that threatened the sustainability of his MFI, with a rate of outstanding debts of around 16%! But "risk management is not limited to credit," he recalls. "There are bilateral impacts that also impact human resource management and cash flow. We had to take these factors into account."

Listening and involvement of all departments: the keys to success

The coaching started with the implementation of an action plan designed by Yombo Odanou, who took the time to clearly identify his priorities. "Yombo was the only actor in the implementation of this plan: my role, more complementary, was rather to challenge him, question him to push him to find the right solutions. Often, the General Managers are single men who have no one to talk to. Coaching allows them to have an interlocutor with whom they take the time to ask the right questions." It should be noted that the action plan is funded in full by the institution itself.

According to Philippe Gérard, the most difficult thing in coaching is active listening: "You have to understand where are the springs of action to identify the existing dynamic and use it to move forward". There is a paradox in Africa, in the sense that culture is very supportive, and at the same time, the various departments of an institution often have difficulty in trusting each other. "CECA was different from what I've seen so far: there was a high level of trust among all departments, enabled by Yombo's strong involvement and enthusiastic personality. This is a factor that has contributed to the success of this coaching." Following this, Yombo Odanou said that "every actor of the institution contributes to the achievement of the result". To do so, CECA has set up a human resources management department to better manage its loan officers and branch heads scattered across the country. "Since the establishment of the department, we have put in place a motivation policy that puts our credit agents and agency heads in competition, in the sense that everyone has clear objectives and is evaluated. regular. Our staff is thus more competent, more qualified and more stable."

"A loan in a microfinance institution is different from a traditional bank loan"

Philippe Gérard observed a notable difference with coaching at the level of a microfinance institution: "There is a perpetual tension to want to produce always more, to produce risk even if the economic situation is not good. In microfinance, microcredit is the only source of income, the very one that makes the institution live. Unlike banks, the challenge in microfinance is to find cash to lend, because you can lend only the money available. When there is no more money, there is no more money! ".

The coaching allowed the creation of a department in risk management

In view of the data for 2015-2017, a step has been taken at the level of the CECA, in particular in terms of control of outstanding payments, growth of the credit activity and more appropriate management. After the coaching period, from 2015 to 2016, the microfinance institution set up a risk management department led by a Management Committee. CECA has since reduced its overdue receivables by more than 60% and increased its average credit by 14%, from € 1,384 at the end of 2015 to € 1,582 at the end of 2017. In the end, we can say that coaching has brought changes beneficial in the CECA. "CECA can say today that it is proud of choice, it was a paying strategy" ,concludes Yombo Odanou.

The speakers of this Midi

Philippe Gérard, Consultant and teacher in banking and finance in Lomé (Togo)

After studying law and economics, Philippe Gérard embarked on a 30-year banking career in Europe (Belgium, the Netherlands, France) and Asia (Singapore, Hong Kong), initially in the commercial field, and then moved on to credit risk management, Asset and Liability Management (ALM), operational and finally finance as Treasurer and Chief Financial Officer.

From 2010, he trained in microfinance in Bangladesh, Tajikistan and the Philippines.

Installed since 2011 in Africa, first in Kinshasa then in Lomé, he works in Central Africa and West Africa as a consultant and teacher in risk and finance.

Yombo Odanou, General Manager of the Coopérative d’Epargne et de Crédit des Artisans (CECA) in Lomé (Togo) and President of the APSFD-Togo (Professional Association of Decentralized Financial Systems)

Yombo Odanou has a combined professional experience of 21 years in microfinance. He holds a Master's degree in business management, a postgraduate degree in banking from Paris (ITB Paris) and a professional Master in microfinance.

Since 2003, he is the General Manager of the Coopérative d’Epargne et de Crédit des Artisans (CECA), one of the largest decentralized financial systems in Togo with over 25 years of experience, whose mission is to offer financial and non-financial services to artisans, especially micro-entrepreneurs in Togo.

He is the current President of the Professional Association of Decentralized Financial Systems of Togo (APSFD-Togo). He is also an intuitu personae member of the National Credit Council of Togo (BCEAO-Togo).

He played a leading role in the implementation of the first national microfinance strategy of his country, Togo, under the Support Program for the National Microfinance Strategy (PASNAM), thanks to his position member of the Steering Committee of this program.

At the regional level, he has in-depth knowledge of the African microfinance networks. He is currently the First Vice-President of the Federation of Professional Associations of Decentralized Financial Systems of UEMOA (FAPSFD-UEMOA) and the President of the African Microfinance Transparency Forum (AMT), that led to the marriage of the AMT and the Microfinance African Institutions Network (MAIN) at the last African Microfinance Week (SAM 2017) held in Addis Ababa, Ethiopia. He is also a member of the Steering Committee of the SAM. In addition to his professional activities, he is a teacher at the Togo Banking Training Center (CFBT).

Luc Vandeweerd, Executive advisor at ADA (Luxembourg)

Luc Vandeweerd was graduated in 1978 from the Catholic University of Louvain in Belgium with a Master's degree in Social Communication. He has worked for 20 years at the International Labor Organization (ILO) as an expert in cooperatives and microfinance on various technical cooperation projects in Africa.

From 1992 to 2002, Mr. Vandeweerd is appointed Director of the PASMEC project in Dakar, Senegal, to support the development of microfinance in West Africa. This project was implemented by the ILO in collaboration with the Central Bank of West African States. In 2002, he joined the NGO ADA in Luxembourg.

Ben Lyon, Director, Head of ATTF Services – House of Training (Luxembourg)

Ben Lyon is a Director at the House of Training, responsible for ATTF services delivering training projects, programmes and assistance to developing countries on behalf of the Luxembourg Government. He has 23 years of financial services experience and his skills include the creation and delivery of training, investment funds, customer service, people management, coaching and projects.

Before joining the ATTF, Ben worked for 6 years with the Institut de Formation Bancaire Luxembourg (IFBL). Prior to this he worked within the fund industry as the Head of Customer support with RBC Dexia, was both Operations Manager and Customer Service Manager at Franklin Templeton, was a Business consultant for IBM and held various positions at Fleming Asset management (now part of JP Morgan).

Ben speaks all the local languages and holds a degree in International Management from the University of Manchester, Institute of Science and Technology.

Patrick Felten, Chief Risk Officer at Banque de Luxembourg

Patrick Felten is Chief Risk Officer at Banque de Luxembourg, focusing on managing all types of Risks faced by the bank, including Financial Risks, Operational Risks and Information Security Risks.

He joined Banque de Luxembourg after his studies in 2000. He worked in the International Department and the Treasury Department of the Banque de Luxembourg before being appointed Chief Risk Officer in 2010.

Patrick Felten holds a Master in Finance (London Business School), a Master in Business Administration (University of St Gallen, Switzerland) and a Master in Mechanical Engineering (ETH Zurich, Switzerland).

An ADA coach testifies

Gauthier Malnoury is an agroeconomist by training and project manager at ADA since 2016. He was trained in the coaching approach by Gilles Ossona de Mendez, a professional coach in Luxembourg. This allowed Gauthier to support FUCEC (Microfinance Institution in Togo) in its process of designing agricultural financing products, as part of a project set up by ADA in early 2017. He tells us his vision of the coaching approach as he saw it during his experience in Togo.

What is your vision of the role of coach?

In my opinion, the coach must guide the coachee and help him "give birth" to his ideas, structure them, help him to stay on track, sometimes to synthesize, clarify, etc. On the other hand, the coach must take care not to impose his way of doing things, and not to make the problem of the coachee his own! He must keep in mind that the coachee must be an actor of change and get involved in the process.

Thus, the coach must be more focused on the framework and structure his ideas, working on the relationship with the coachee. Once the framework is well defined and mastered, the coachee can evolve and focus on the content. As for me, the coaching approach brings an additional string to the technical expert's bow, since it allows "tailor-made" support, adapted to the level of the operational and strategic development of the institution.

According to you, in what state of mind should be the coach towards his "pupils"?

Being a coach implies questioning this tendency that we all have to absolutely want to give ready-made solutions. This reflex, conditioned by our training and past professional experiences, is not always easy to control. The feedbacks I have got from the professional coach allowed me to become aware of it and thus readjust my coaching position in the moments when I drifted away to the consultant mode. Using the techniques learned (meta communication, synchronization, etc.), I was able to reorient the discussion and refocus the coachee into the heart of the reflection.

I also realized that the coach had to be and remain convinced throughout the process that:

- the coachee has the solutions in him but he is not necessarily aware of it;

- the coachee has the potential to improve;

- the quality of the coach-coached relationship allows the coachee to reveal his potential and find the most adapted and sustainable solutions.

Would you say that it is an asset or a threat to have expertise in agricultural finance?

Having knowledge in agricultural finance allowed me to establish a relationship of trust between the coachee and I.

When the coachee describes the "real" (the context in which his challenge is to be taken), knowing the theme allows the coach to master the technical vocabulary, avoiding him to clarify the content. The coach can quickly begin to challenge the coachee with a set of questions to allow him to formulate his needs.

I also realized that the coachee was not always aware of the other agricultural finance initiatives implemented in other countries, even in the sub-region (warrantage in Burkina Faso, input savings plan in Burkina Faso, Mali, etc.), I used my experience in agricultural finance to inspire the coachee, based on concrete cases that I had observed in the past, without influencing him.

Once again, the objective is to bring out the ideas of the coachee who knows better the needs of the institution than the coach, in order to identify "tailor-made" solutions.

Do you think that the posture has an impact on the reaction of the coachees?

Yes, I was surprised by the impact of the posture and the spatial arrangement (on both sides of a table, sitting next to each other, etc.) on the dynamics of exchanges, which lasted several hours. Often, I willingly changed my place by explaining to the coachee why I was doing this, making sure that it does not cause him any problem.

I also learned to better synchronize with him and better control the balance between control of trade and autonomy. It is important, in my opinion, to reach and maintain a healthy situation ("one is together") so that one or the other does not feel in a lower or higher position than the other.

Are there any particular techniques that can put the coachee in confidence?

The first day of exchanges, I tended to suggest too much and not leave enough time and space for the coachee to answer and reflect. He retreated little by little, that's when I realized that I monopolized speech too much. It is important to leave silences to allow time for reflection.

The techniques of reformulation of the preconceived answers of the coachee that I used allowed him to concentrate and to deepen certain points.

A climate of trust quickly developed between us. So I had more opportunities to explain to him why I was asking seemingly confusing questions and why I changed places so often. This technique has been very effective in maintaining the alliance and avoiding misunderstandings.

This 43rd Midi de la microfinance is organised with the support of the Directorate for Development Cooperation and Humanitarian Affairs, the InFiNe.lu network and the Banque de Luxembourg, in collaboration with House of Training - ATTF and ALRiM.

The Midis de la microfinance are held during lunch breaks, between 12 and 2 p.m. Their agenda includes the presentation by an inclusive-finance expert of a study or a practical case, which is followed by a questions and answers session with the audience. At the end, a lunch is offered to all the participants.